Large Stocks Going Cheap

Some large companies have their stocks languishing at multi-year lows ahead of the budget. Prem Doshi of Ace Equities analyses the outlook for these major stocks exclusively for GoNews.

Leading indices Sensex & Nifty remain close to their all time highs ahead of the budget.

While a handful of index stocks have sustained in the bull run, some large companies have their stocks languishing at multi year lows on EV/Ebidta and Market Cap to Sales valuation charts. Enterprise multiple: Also known as the EV/EBITDA multiple, is a ratio often used to determine the value of a company. The EV/EBITDA ratio is a comparison of enterprise value and earnings before interest, taxes, depreciation and amortisation.The enterprise multiple looks at a firm in the way that a potential acquirer would by considering the company's debt. Market Cap to Sales: Also known as Price/Sales ratio is calculated by taking a company's market and dividing it by the company's total sales or revenue over the past 12 months.The lower the EV/EBIDTA multiple and Market Cap/Sales ratio, the more attractive the investment. Analysts and investors focusing on value investing approach often look at opportunities like this for stocks to add to their portfolios. So here are 5 Large Stocks at multi year valuation lows. 1 – ITC Ltd – CMP 238 ITC Ltd has a diversified presence in FMCG, Hotels, Paperboards & Specialty Papers, Packaging, Agri-Business, and Information Technology. ITC is the market leader in India in the cigarette business with a market share of more than 80% with cigarette brands such as Insignia, India Kings, Classic, Gold Flake, American Club, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut, Duke & Royal and a few more. ITC is also into the FMCG business with brands such as Aashirvaad, Sunfeast, Bingo!, Kitchens of India, YiPPee!, B Natural, mint-o, Candyman, GumOn, Fabelle, Sunbean, Sunfeast Wonderz Milk, ITC Master Chef, Farmland, Essenza Di Wills, Dermafique, Fiama, Vivel, Engage, Superia, Nimyle, Savlon, Shower to Shower,v Charmis and more. ITC is also into hotels, paperboards, packaging and agri-exports. As evident in the above charts, even though the stock price has rallied in the last 10 years the financials of the company has delivered much more growth.

As a result of this the stock today trades at multiyear valuation lows, with market cap to sales of around 6x which is nearly the lowest in last 10 year and EV/Ebidta of under 14 which is the lowest in last 10 years.

One potential reason for this de-rating of the stock is that the street expects the Government will continue to penalise and add additional taxes on cigarettes to fill up the govt coffers, however Goverment and PSU entities like LIC held approx 28% stake in ITC Ltd at the end of December quarter.

The Government also recently banned e-cigarettes which may stand to benefit ITC Ltd, if harsh tax measures are not undertaken on cigarettes this budget, ITC surely is a stock to watch going ahead.

2 – Exide Industries Ltd – CMP 197

Exide Industries Ltd manufactures the widest range of storage batteries in the world covering the broadest spectrum of applications.

In automotive batteries it owns and sells Exide, SF, Sonic, Standard Furukawa, Dynex, Index & Sonic brands. Industrial Batteries and Submarine Batteries are other product categories for the company in the battery space while Exide Life Insurance is their insurance venture.

With all the Electric Vehicle hype, automobile slowdown buzz and competition from Amaraja Batteries brand Amaron lagging it in recent times, the Exide stock price has not done much in the last 10 years either.

As evident in the above charts, even though the stock price has rallied in the last 10 years the financials of the company has delivered much more growth.

As a result of this the stock today trades at multiyear valuation lows, with market cap to sales of around 6x which is nearly the lowest in last 10 year and EV/Ebidta of under 14 which is the lowest in last 10 years.

One potential reason for this de-rating of the stock is that the street expects the Government will continue to penalise and add additional taxes on cigarettes to fill up the govt coffers, however Goverment and PSU entities like LIC held approx 28% stake in ITC Ltd at the end of December quarter.

The Government also recently banned e-cigarettes which may stand to benefit ITC Ltd, if harsh tax measures are not undertaken on cigarettes this budget, ITC surely is a stock to watch going ahead.

2 – Exide Industries Ltd – CMP 197

Exide Industries Ltd manufactures the widest range of storage batteries in the world covering the broadest spectrum of applications.

In automotive batteries it owns and sells Exide, SF, Sonic, Standard Furukawa, Dynex, Index & Sonic brands. Industrial Batteries and Submarine Batteries are other product categories for the company in the battery space while Exide Life Insurance is their insurance venture.

With all the Electric Vehicle hype, automobile slowdown buzz and competition from Amaraja Batteries brand Amaron lagging it in recent times, the Exide stock price has not done much in the last 10 years either.

Before the market share for Amaron expanded, Exide was almost a synonym for automobile batteries in India and even today it retains the largest market share. On the valuation ratios front, Exide is ruling close to a 10 year low market cap to sales ratio of under 1.5x and Ev/Ebidta of under 11x.

With such historical low in valuations, this stock should be on the radar of all the value hunters.

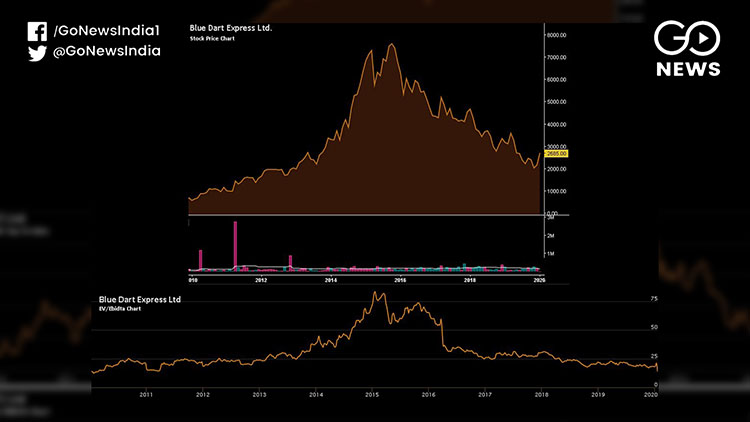

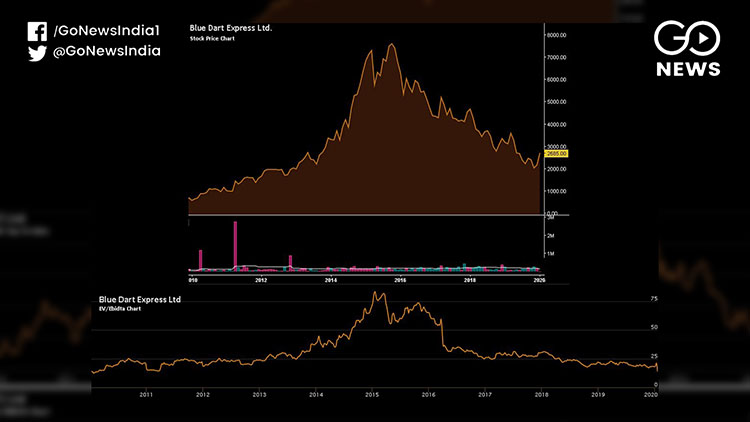

3 – Bluedart Express Ltd – CMP 2685

Blue Dart Express Ltd is a premier courier, and integrated express package distribution company founded by Tushar Jani, Khushroo Dubash and Clyde Cooper in 1983. After a deal in 2004, multinational courier and parcel major DHL holds the promoter stake in the company.

The Bluedart stock price has crashed from heights of around 8000 hit in 2015 to a low of close to 2000 it recently made. E-Commerce accounts for almost 18% of the company’s overall revenue and B2B Logistics has the largest share at 80% +.

Before the market share for Amaron expanded, Exide was almost a synonym for automobile batteries in India and even today it retains the largest market share. On the valuation ratios front, Exide is ruling close to a 10 year low market cap to sales ratio of under 1.5x and Ev/Ebidta of under 11x.

With such historical low in valuations, this stock should be on the radar of all the value hunters.

3 – Bluedart Express Ltd – CMP 2685

Blue Dart Express Ltd is a premier courier, and integrated express package distribution company founded by Tushar Jani, Khushroo Dubash and Clyde Cooper in 1983. After a deal in 2004, multinational courier and parcel major DHL holds the promoter stake in the company.

The Bluedart stock price has crashed from heights of around 8000 hit in 2015 to a low of close to 2000 it recently made. E-Commerce accounts for almost 18% of the company’s overall revenue and B2B Logistics has the largest share at 80% +.

The E-commerce side of the business might have been impacted with start-ups like Delhivery emerging and the likes of Amazon/Flipkart/Myntra preferring their own logistic ventures to deliver the packages.

On the valuations front, the stock is trading close to 10 year low on EV/Ebidta charts at under 14x.

With MNC promoter and largest market share of over 45% in air logistics in India and a softening crude price, Bluedart should be on the watch list for a risky value hunting opportunity.

4 – Godrej Industries Ltd – CMP 433

Godrej Industries Ltd is the holding company of many other listed and unlisted subsidiaries such as Godrej Consumer Products, Godrej Agrovet, Godrej Properties etc.

In the last 10 years, individually listed businesses of the Godrej Group such as Godrej Consumer Products and Godrej Properties have done really well. The holding company Godrej Industries too has performed well over that period of time.

The E-commerce side of the business might have been impacted with start-ups like Delhivery emerging and the likes of Amazon/Flipkart/Myntra preferring their own logistic ventures to deliver the packages.

On the valuations front, the stock is trading close to 10 year low on EV/Ebidta charts at under 14x.

With MNC promoter and largest market share of over 45% in air logistics in India and a softening crude price, Bluedart should be on the watch list for a risky value hunting opportunity.

4 – Godrej Industries Ltd – CMP 433

Godrej Industries Ltd is the holding company of many other listed and unlisted subsidiaries such as Godrej Consumer Products, Godrej Agrovet, Godrej Properties etc.

In the last 10 years, individually listed businesses of the Godrej Group such as Godrej Consumer Products and Godrej Properties have done really well. The holding company Godrej Industries too has performed well over that period of time.

But of late, the stock has corrected sharply by almost 40-50% from its highs. Godrej Ind trades at market cap/sales of around 1.3x from its recent low of close to 1.1x and Ev/Ebidta of around 16x. Even though holding company discount can impact re-rating chances, its multiyear low in terms of valuations make an interesting case.

Historically, the stock has seen a good bounce-back from such valuations so it should be on the watchlist of value investors.

5 – Sun Pharmaceuticals Ltd – CMP 447

Sun Pharmaceutical Industries Limited is an Indian multinational pharmaceutical company headquartered in Mumbai, Maharashtra, that manufactures and sells pharmaceutical formulations and active pharmaceutical ingredients (APIs) primarily in India and the United States. Sun Pharma was established by Mr. Dilip Shanghvi in 1983 in Vapi, Gujarat.

Sun Pharma is the world's fourth largest specialty generic pharmaceutical company and India's top pharmaceutical company. In India, the company is a leader in niche therapy areas of psychiatry, neurology, cardiology, diabetology, gastroenterology, orthopaedics and ophthalmology.

Its global presence is supported by 41 manufacturing facilities spread across six continents and research and development (R&D) centres across the world.

Sun Pharma made all the headlines in 2015 when the stock price of the company went on to hit a life high at 1200 and its promoter Dilip Shanghvi became the richest Indian on the Forbes list.

However, the happiness did not last for the shareholders. While USFDA warnings, inspection, bans and other issues cropped up one after another in the Indian pharma sector, Sun Pharma too was not immune to the disturbance.

The stock ended up dipping as much as 71% from its lifetime high to a low of close to 340.

But of late, the stock has corrected sharply by almost 40-50% from its highs. Godrej Ind trades at market cap/sales of around 1.3x from its recent low of close to 1.1x and Ev/Ebidta of around 16x. Even though holding company discount can impact re-rating chances, its multiyear low in terms of valuations make an interesting case.

Historically, the stock has seen a good bounce-back from such valuations so it should be on the watchlist of value investors.

5 – Sun Pharmaceuticals Ltd – CMP 447

Sun Pharmaceutical Industries Limited is an Indian multinational pharmaceutical company headquartered in Mumbai, Maharashtra, that manufactures and sells pharmaceutical formulations and active pharmaceutical ingredients (APIs) primarily in India and the United States. Sun Pharma was established by Mr. Dilip Shanghvi in 1983 in Vapi, Gujarat.

Sun Pharma is the world's fourth largest specialty generic pharmaceutical company and India's top pharmaceutical company. In India, the company is a leader in niche therapy areas of psychiatry, neurology, cardiology, diabetology, gastroenterology, orthopaedics and ophthalmology.

Its global presence is supported by 41 manufacturing facilities spread across six continents and research and development (R&D) centres across the world.

Sun Pharma made all the headlines in 2015 when the stock price of the company went on to hit a life high at 1200 and its promoter Dilip Shanghvi became the richest Indian on the Forbes list.

However, the happiness did not last for the shareholders. While USFDA warnings, inspection, bans and other issues cropped up one after another in the Indian pharma sector, Sun Pharma too was not immune to the disturbance.

The stock ended up dipping as much as 71% from its lifetime high to a low of close to 340.

Despite being the largest Indian pharma company, the stock currently trades close to a historical low per its own valuations. At market cap/sales of 3.4x currently, not far from a recent and all time low of close to 3x and an EV/Ebidta of 14x not too far from a 2017 low of close to 11x, Sun Pharma should be a stock to watch out for.

Despite being the largest Indian pharma company, the stock currently trades close to a historical low per its own valuations. At market cap/sales of 3.4x currently, not far from a recent and all time low of close to 3x and an EV/Ebidta of 14x not too far from a 2017 low of close to 11x, Sun Pharma should be a stock to watch out for.

While a handful of index stocks have sustained in the bull run, some large companies have their stocks languishing at multi year lows on EV/Ebidta and Market Cap to Sales valuation charts. Enterprise multiple: Also known as the EV/EBITDA multiple, is a ratio often used to determine the value of a company. The EV/EBITDA ratio is a comparison of enterprise value and earnings before interest, taxes, depreciation and amortisation.The enterprise multiple looks at a firm in the way that a potential acquirer would by considering the company's debt. Market Cap to Sales: Also known as Price/Sales ratio is calculated by taking a company's market and dividing it by the company's total sales or revenue over the past 12 months.The lower the EV/EBIDTA multiple and Market Cap/Sales ratio, the more attractive the investment. Analysts and investors focusing on value investing approach often look at opportunities like this for stocks to add to their portfolios. So here are 5 Large Stocks at multi year valuation lows. 1 – ITC Ltd – CMP 238 ITC Ltd has a diversified presence in FMCG, Hotels, Paperboards & Specialty Papers, Packaging, Agri-Business, and Information Technology. ITC is the market leader in India in the cigarette business with a market share of more than 80% with cigarette brands such as Insignia, India Kings, Classic, Gold Flake, American Club, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut, Duke & Royal and a few more. ITC is also into the FMCG business with brands such as Aashirvaad, Sunfeast, Bingo!, Kitchens of India, YiPPee!, B Natural, mint-o, Candyman, GumOn, Fabelle, Sunbean, Sunfeast Wonderz Milk, ITC Master Chef, Farmland, Essenza Di Wills, Dermafique, Fiama, Vivel, Engage, Superia, Nimyle, Savlon, Shower to Shower,v Charmis and more. ITC is also into hotels, paperboards, packaging and agri-exports.

As evident in the above charts, even though the stock price has rallied in the last 10 years the financials of the company has delivered much more growth.

As a result of this the stock today trades at multiyear valuation lows, with market cap to sales of around 6x which is nearly the lowest in last 10 year and EV/Ebidta of under 14 which is the lowest in last 10 years.

One potential reason for this de-rating of the stock is that the street expects the Government will continue to penalise and add additional taxes on cigarettes to fill up the govt coffers, however Goverment and PSU entities like LIC held approx 28% stake in ITC Ltd at the end of December quarter.

The Government also recently banned e-cigarettes which may stand to benefit ITC Ltd, if harsh tax measures are not undertaken on cigarettes this budget, ITC surely is a stock to watch going ahead.

2 – Exide Industries Ltd – CMP 197

Exide Industries Ltd manufactures the widest range of storage batteries in the world covering the broadest spectrum of applications.

In automotive batteries it owns and sells Exide, SF, Sonic, Standard Furukawa, Dynex, Index & Sonic brands. Industrial Batteries and Submarine Batteries are other product categories for the company in the battery space while Exide Life Insurance is their insurance venture.

With all the Electric Vehicle hype, automobile slowdown buzz and competition from Amaraja Batteries brand Amaron lagging it in recent times, the Exide stock price has not done much in the last 10 years either.

As evident in the above charts, even though the stock price has rallied in the last 10 years the financials of the company has delivered much more growth.

As a result of this the stock today trades at multiyear valuation lows, with market cap to sales of around 6x which is nearly the lowest in last 10 year and EV/Ebidta of under 14 which is the lowest in last 10 years.

One potential reason for this de-rating of the stock is that the street expects the Government will continue to penalise and add additional taxes on cigarettes to fill up the govt coffers, however Goverment and PSU entities like LIC held approx 28% stake in ITC Ltd at the end of December quarter.

The Government also recently banned e-cigarettes which may stand to benefit ITC Ltd, if harsh tax measures are not undertaken on cigarettes this budget, ITC surely is a stock to watch going ahead.

2 – Exide Industries Ltd – CMP 197

Exide Industries Ltd manufactures the widest range of storage batteries in the world covering the broadest spectrum of applications.

In automotive batteries it owns and sells Exide, SF, Sonic, Standard Furukawa, Dynex, Index & Sonic brands. Industrial Batteries and Submarine Batteries are other product categories for the company in the battery space while Exide Life Insurance is their insurance venture.

With all the Electric Vehicle hype, automobile slowdown buzz and competition from Amaraja Batteries brand Amaron lagging it in recent times, the Exide stock price has not done much in the last 10 years either.

Before the market share for Amaron expanded, Exide was almost a synonym for automobile batteries in India and even today it retains the largest market share. On the valuation ratios front, Exide is ruling close to a 10 year low market cap to sales ratio of under 1.5x and Ev/Ebidta of under 11x.

With such historical low in valuations, this stock should be on the radar of all the value hunters.

3 – Bluedart Express Ltd – CMP 2685

Blue Dart Express Ltd is a premier courier, and integrated express package distribution company founded by Tushar Jani, Khushroo Dubash and Clyde Cooper in 1983. After a deal in 2004, multinational courier and parcel major DHL holds the promoter stake in the company.

The Bluedart stock price has crashed from heights of around 8000 hit in 2015 to a low of close to 2000 it recently made. E-Commerce accounts for almost 18% of the company’s overall revenue and B2B Logistics has the largest share at 80% +.

Before the market share for Amaron expanded, Exide was almost a synonym for automobile batteries in India and even today it retains the largest market share. On the valuation ratios front, Exide is ruling close to a 10 year low market cap to sales ratio of under 1.5x and Ev/Ebidta of under 11x.

With such historical low in valuations, this stock should be on the radar of all the value hunters.

3 – Bluedart Express Ltd – CMP 2685

Blue Dart Express Ltd is a premier courier, and integrated express package distribution company founded by Tushar Jani, Khushroo Dubash and Clyde Cooper in 1983. After a deal in 2004, multinational courier and parcel major DHL holds the promoter stake in the company.

The Bluedart stock price has crashed from heights of around 8000 hit in 2015 to a low of close to 2000 it recently made. E-Commerce accounts for almost 18% of the company’s overall revenue and B2B Logistics has the largest share at 80% +.

The E-commerce side of the business might have been impacted with start-ups like Delhivery emerging and the likes of Amazon/Flipkart/Myntra preferring their own logistic ventures to deliver the packages.

On the valuations front, the stock is trading close to 10 year low on EV/Ebidta charts at under 14x.

With MNC promoter and largest market share of over 45% in air logistics in India and a softening crude price, Bluedart should be on the watch list for a risky value hunting opportunity.

4 – Godrej Industries Ltd – CMP 433

Godrej Industries Ltd is the holding company of many other listed and unlisted subsidiaries such as Godrej Consumer Products, Godrej Agrovet, Godrej Properties etc.

In the last 10 years, individually listed businesses of the Godrej Group such as Godrej Consumer Products and Godrej Properties have done really well. The holding company Godrej Industries too has performed well over that period of time.

The E-commerce side of the business might have been impacted with start-ups like Delhivery emerging and the likes of Amazon/Flipkart/Myntra preferring their own logistic ventures to deliver the packages.

On the valuations front, the stock is trading close to 10 year low on EV/Ebidta charts at under 14x.

With MNC promoter and largest market share of over 45% in air logistics in India and a softening crude price, Bluedart should be on the watch list for a risky value hunting opportunity.

4 – Godrej Industries Ltd – CMP 433

Godrej Industries Ltd is the holding company of many other listed and unlisted subsidiaries such as Godrej Consumer Products, Godrej Agrovet, Godrej Properties etc.

In the last 10 years, individually listed businesses of the Godrej Group such as Godrej Consumer Products and Godrej Properties have done really well. The holding company Godrej Industries too has performed well over that period of time.

But of late, the stock has corrected sharply by almost 40-50% from its highs. Godrej Ind trades at market cap/sales of around 1.3x from its recent low of close to 1.1x and Ev/Ebidta of around 16x. Even though holding company discount can impact re-rating chances, its multiyear low in terms of valuations make an interesting case.

Historically, the stock has seen a good bounce-back from such valuations so it should be on the watchlist of value investors.

5 – Sun Pharmaceuticals Ltd – CMP 447

Sun Pharmaceutical Industries Limited is an Indian multinational pharmaceutical company headquartered in Mumbai, Maharashtra, that manufactures and sells pharmaceutical formulations and active pharmaceutical ingredients (APIs) primarily in India and the United States. Sun Pharma was established by Mr. Dilip Shanghvi in 1983 in Vapi, Gujarat.

Sun Pharma is the world's fourth largest specialty generic pharmaceutical company and India's top pharmaceutical company. In India, the company is a leader in niche therapy areas of psychiatry, neurology, cardiology, diabetology, gastroenterology, orthopaedics and ophthalmology.

Its global presence is supported by 41 manufacturing facilities spread across six continents and research and development (R&D) centres across the world.

Sun Pharma made all the headlines in 2015 when the stock price of the company went on to hit a life high at 1200 and its promoter Dilip Shanghvi became the richest Indian on the Forbes list.

However, the happiness did not last for the shareholders. While USFDA warnings, inspection, bans and other issues cropped up one after another in the Indian pharma sector, Sun Pharma too was not immune to the disturbance.

The stock ended up dipping as much as 71% from its lifetime high to a low of close to 340.

But of late, the stock has corrected sharply by almost 40-50% from its highs. Godrej Ind trades at market cap/sales of around 1.3x from its recent low of close to 1.1x and Ev/Ebidta of around 16x. Even though holding company discount can impact re-rating chances, its multiyear low in terms of valuations make an interesting case.

Historically, the stock has seen a good bounce-back from such valuations so it should be on the watchlist of value investors.

5 – Sun Pharmaceuticals Ltd – CMP 447

Sun Pharmaceutical Industries Limited is an Indian multinational pharmaceutical company headquartered in Mumbai, Maharashtra, that manufactures and sells pharmaceutical formulations and active pharmaceutical ingredients (APIs) primarily in India and the United States. Sun Pharma was established by Mr. Dilip Shanghvi in 1983 in Vapi, Gujarat.

Sun Pharma is the world's fourth largest specialty generic pharmaceutical company and India's top pharmaceutical company. In India, the company is a leader in niche therapy areas of psychiatry, neurology, cardiology, diabetology, gastroenterology, orthopaedics and ophthalmology.

Its global presence is supported by 41 manufacturing facilities spread across six continents and research and development (R&D) centres across the world.

Sun Pharma made all the headlines in 2015 when the stock price of the company went on to hit a life high at 1200 and its promoter Dilip Shanghvi became the richest Indian on the Forbes list.

However, the happiness did not last for the shareholders. While USFDA warnings, inspection, bans and other issues cropped up one after another in the Indian pharma sector, Sun Pharma too was not immune to the disturbance.

The stock ended up dipping as much as 71% from its lifetime high to a low of close to 340.

Despite being the largest Indian pharma company, the stock currently trades close to a historical low per its own valuations. At market cap/sales of 3.4x currently, not far from a recent and all time low of close to 3x and an EV/Ebidta of 14x not too far from a 2017 low of close to 11x, Sun Pharma should be a stock to watch out for.

Despite being the largest Indian pharma company, the stock currently trades close to a historical low per its own valuations. At market cap/sales of 3.4x currently, not far from a recent and all time low of close to 3x and an EV/Ebidta of 14x not too far from a 2017 low of close to 11x, Sun Pharma should be a stock to watch out for.

Latest Videos