Claimants Received 26% Less From Insurers During COVID Pandemic

The figures released by General Insurance Council show that from March 2020 until August 2021, the total number of COVID-related claims received by insurance companies number at 25.64 lakh, worth ₹31,624 crore. Of these, 22.38 lakh claims for ₹20,430 crore have been settled, and 4.17% of the claims have been rejected, i.e., claims of ₹1,139 crore have been repudiated.

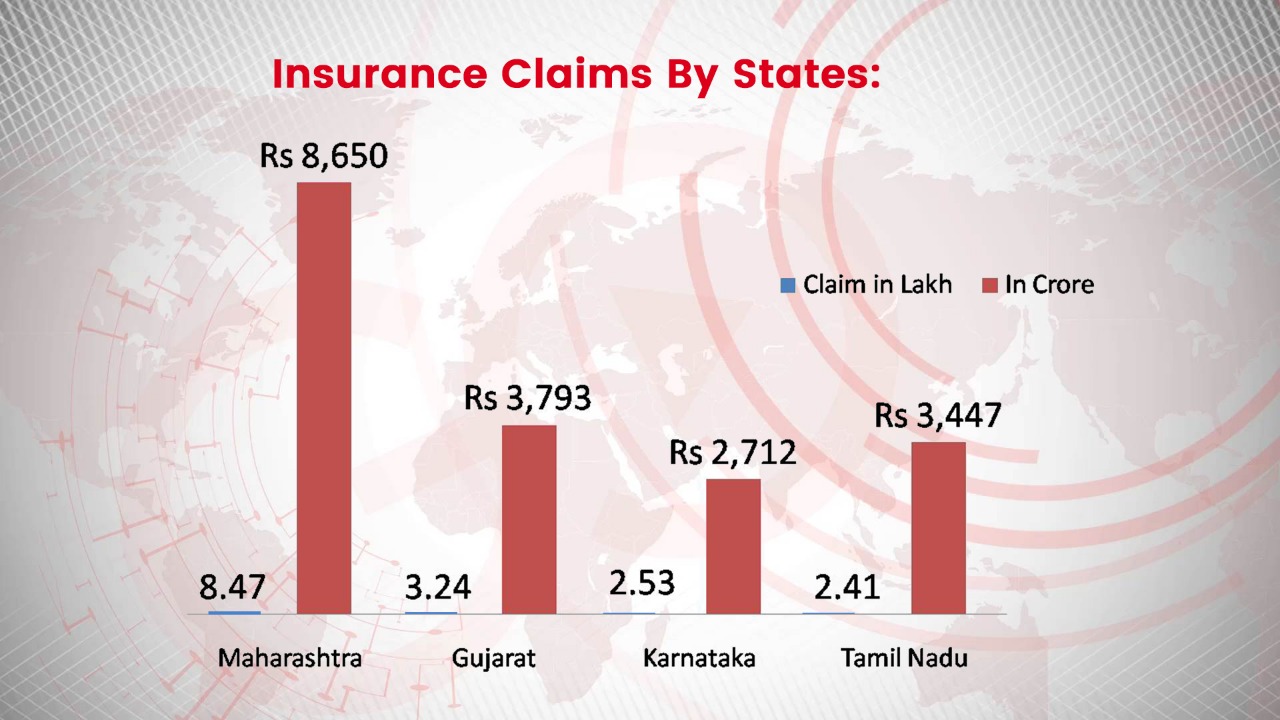

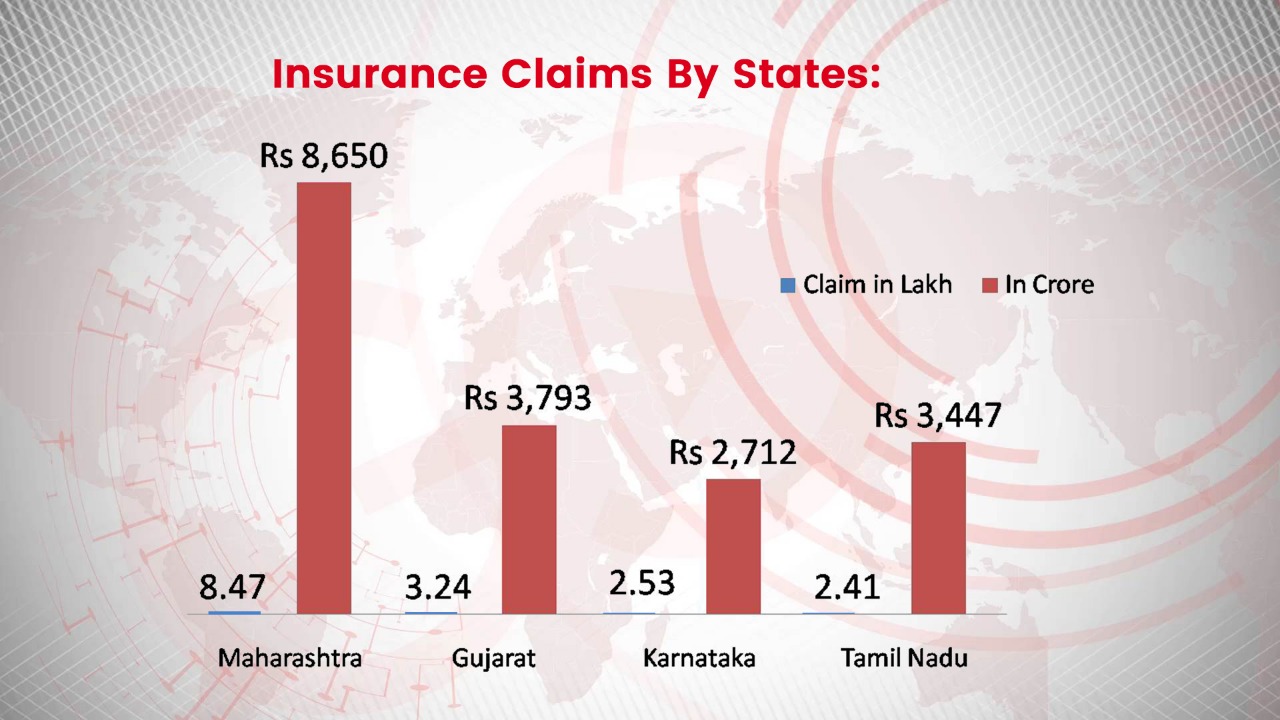

Of the ₹31,624 crore claimed, ₹20,430 crore , i.e. 74% have been settled. This shows that customers have received 26% less than they have claimed from insurers. Maharashtra tops the chart for the states with the most insurance claims filed. Telangana has the highest average claim per person at ₹1.72 lakh and Arunachal Pradesh has the highest settled claim per person at ₹1.24 lakh.

In August 6th, claims of ₹10,703 were pending with insurance companies, while 23.06 lakh claims of ₹29,341 crore were received. Of this figure, 13.1 lakh claims of ₹14,783 crore were received between April- August 2021.

Covid insurance claims as a proportion of total health claims rose from 33% during the first wave in April-August 2020 to 48% during the second wave in April-June 2021.

The RBI had released its ‘Financial Stability Report’ in July 2021 which stated that there were 22,205 insurance claims worth ₹1,644.56 crore in FY 2020-21. The Times of India reported that life insurance claims saw a 5-10 times increase in April 2021, one of the peak months of the deadly second wave.

Quoting figures from Macquarie Research, it also showed that In FY 2020-21, the total number of Covid-related deaths that led to life insurance claims were 25,000 out of the 1,62,892 deaths. India Brand Equity Foundation (IBEF) has stated that the insurance penetration in the country 3.76% in FY 2019-20, of which life insurance was 2.82% and non-life insurance was 0.94%. Around 18% of the urban population and 14% of rural people have been insured in the country.

The insurance industry’s total assets under management grew from ₹1.5 trillion in 2000-01 to ₹37.75 trillion in 2019-20. The sum assured grew from 50.1% of GDP in 2002 to 85% of GDP in 2021.

In August 6th, claims of ₹10,703 were pending with insurance companies, while 23.06 lakh claims of ₹29,341 crore were received. Of this figure, 13.1 lakh claims of ₹14,783 crore were received between April- August 2021.

Covid insurance claims as a proportion of total health claims rose from 33% during the first wave in April-August 2020 to 48% during the second wave in April-June 2021.

The RBI had released its ‘Financial Stability Report’ in July 2021 which stated that there were 22,205 insurance claims worth ₹1,644.56 crore in FY 2020-21. The Times of India reported that life insurance claims saw a 5-10 times increase in April 2021, one of the peak months of the deadly second wave.

Quoting figures from Macquarie Research, it also showed that In FY 2020-21, the total number of Covid-related deaths that led to life insurance claims were 25,000 out of the 1,62,892 deaths. India Brand Equity Foundation (IBEF) has stated that the insurance penetration in the country 3.76% in FY 2019-20, of which life insurance was 2.82% and non-life insurance was 0.94%. Around 18% of the urban population and 14% of rural people have been insured in the country.

The insurance industry’s total assets under management grew from ₹1.5 trillion in 2000-01 to ₹37.75 trillion in 2019-20. The sum assured grew from 50.1% of GDP in 2002 to 85% of GDP in 2021.

In August 6th, claims of ₹10,703 were pending with insurance companies, while 23.06 lakh claims of ₹29,341 crore were received. Of this figure, 13.1 lakh claims of ₹14,783 crore were received between April- August 2021.

Covid insurance claims as a proportion of total health claims rose from 33% during the first wave in April-August 2020 to 48% during the second wave in April-June 2021.

The RBI had released its ‘Financial Stability Report’ in July 2021 which stated that there were 22,205 insurance claims worth ₹1,644.56 crore in FY 2020-21. The Times of India reported that life insurance claims saw a 5-10 times increase in April 2021, one of the peak months of the deadly second wave.

Quoting figures from Macquarie Research, it also showed that In FY 2020-21, the total number of Covid-related deaths that led to life insurance claims were 25,000 out of the 1,62,892 deaths. India Brand Equity Foundation (IBEF) has stated that the insurance penetration in the country 3.76% in FY 2019-20, of which life insurance was 2.82% and non-life insurance was 0.94%. Around 18% of the urban population and 14% of rural people have been insured in the country.

The insurance industry’s total assets under management grew from ₹1.5 trillion in 2000-01 to ₹37.75 trillion in 2019-20. The sum assured grew from 50.1% of GDP in 2002 to 85% of GDP in 2021.

In August 6th, claims of ₹10,703 were pending with insurance companies, while 23.06 lakh claims of ₹29,341 crore were received. Of this figure, 13.1 lakh claims of ₹14,783 crore were received between April- August 2021.

Covid insurance claims as a proportion of total health claims rose from 33% during the first wave in April-August 2020 to 48% during the second wave in April-June 2021.

The RBI had released its ‘Financial Stability Report’ in July 2021 which stated that there were 22,205 insurance claims worth ₹1,644.56 crore in FY 2020-21. The Times of India reported that life insurance claims saw a 5-10 times increase in April 2021, one of the peak months of the deadly second wave.

Quoting figures from Macquarie Research, it also showed that In FY 2020-21, the total number of Covid-related deaths that led to life insurance claims were 25,000 out of the 1,62,892 deaths. India Brand Equity Foundation (IBEF) has stated that the insurance penetration in the country 3.76% in FY 2019-20, of which life insurance was 2.82% and non-life insurance was 0.94%. Around 18% of the urban population and 14% of rural people have been insured in the country.

The insurance industry’s total assets under management grew from ₹1.5 trillion in 2000-01 to ₹37.75 trillion in 2019-20. The sum assured grew from 50.1% of GDP in 2002 to 85% of GDP in 2021.

Latest Videos