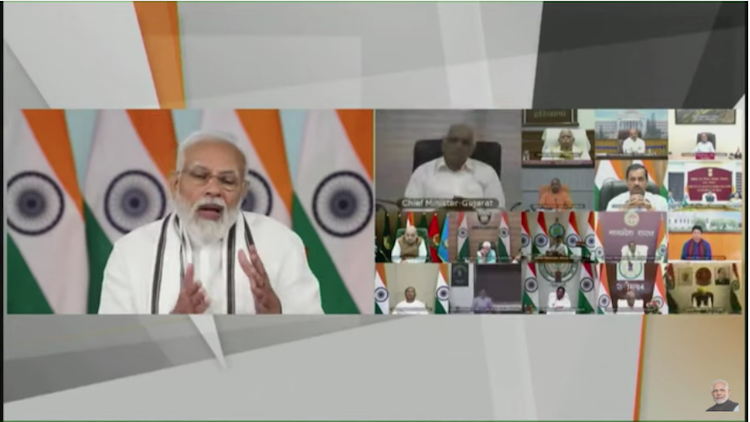

During narendra Modi’s “virtual interaction” with chief ministers yesterday which was apparently convened to discuss the COVID-19 situation, he said in context of rising fuel prices that while the Centre had cut back on its excise duty, states should also follow its lead and slash VAT on fuel. He named seven states ruled by rival parties of the BJP and said that not reducing VAT would be “unfair to your people”. The CM’s who attended the meeting have since expressed their opposition to the comment.

The following chart shows the increase in the Centre’s excise duty on petrol

West Bengal Chief Minister Mamata Banerjee said that it was a “one-sided interaction” without the scope for the chief ministers to respond, calling the PM’s statements ‘misleading and fake’.

She also said that her government has provided a subsidy of Re. 1 on every litre of petrol and diesel for the past three years. She also said that Modi omitted to mention that the Centre owes West Bengal ₹97,000 crore.

Telangana CM K Chandrashekhar Rao said that the Prime Minister should “feel ashamed” for asking the states to cut VAT, saying, “why can’t the Centre slash the taxes instead of asking states”.

Kerala Finance Minister K.N. Balagopal said that Kerala has not increased fuel tax in the past six years, and called the PM’s comments ‘misleading’ like Mamata Banerjee. Balagopal said that the last change in VAT for fuel in Kerala was in 2018 when the Pinarayi Vijayan government cut the VAT on petrol and diesel from 31.80% and 24.75% to 30.80% and 22.7% respectively, facing a revenue loss of ₹15,000 crore as a result.

Balagopal said that it was not feasible for Kerala to cut its resources by slashing VAT unlike Karnataka and Gujarat named by the PM, which have other resources to compensate for the loss. Since the implementation of GST, states are only left with alcohol and fuel taxes as a revenue source.

Maharashtra CM Uddhav Thackeray also said that the Centre receives a greater share on a litre of fuel than the state, at ₹24.38 and ₹22.37 respectively. He stated that the state cabinet has brought a proposal to cut taxes on fuel by ₹1/litre.

Latest Videos